I often see the notion of waiting until your income increases before contributing to your RRSP. I understand the general idea of waiting to get…

Comments closedTag: tax

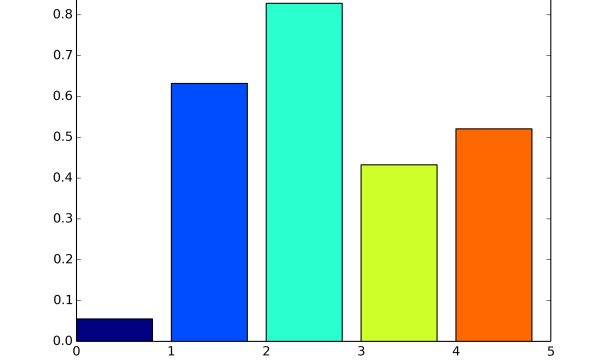

Can I lose money by getting a pay increase? Could my taxes go up higher than my pay increase if it bumps me into a…

Comments closedI have lots of contribution room in my TFSA and RRSP, which should I focus on? Both tax free savings accounts (TFSAs) and registered retirement…

Comments closedI over-contributed to my RRSP in the past two years for which I filed the proper form and paid the interest fee on the over-contributed…

Comments closed1. If I have $0 in income, I can contribute nothing to my RRSP, right? Or is there a minimum every year I can contribute…

Comments closedWhat determines how much income tax I’ll pay in April? When I was making just 18k a year I had a tax bill of around…

Comments closedUsually when we get questions here we try to go into some depth in explaining the situation and possible answers. Other times our answer doesn’t…

Comments closedI’ve got about $100k saved in RRSPs that I want to gradually access over the next four years (25k per year). Knowing this, what are…

Comments closedIf I don’t pay my taxes in time, what’s the penalty? In the short term there isn’t a fixed penalty, exactly, for not paying on…

Comments closedI’ll probably make less than the basic personal amount this year (around $13k?), but I’m still seeing deductions on my payslip. Why is that? Should…

Comments closed