My mortgage is coming up for renewal. I’ve been hearing that people on variable rate mortgages are feeling a lot of pressure right now with rising rates. But my broker told me variable rates have almost always outperformed fixed rates for the past 40 years. Which is right?

It may seem confusing at first, but both pieces of information are correct. Over the past 40 years variable rate mortgages have almost always been better for consumers than fixed rate mortgages. It is also true that, over the past year, people on variable rate mortgages have been hit hard with rising interest rates while people on fixed rates are doing okay.

The key here, I believe, is context. It’s interesting your broker used the 40 year time span specifically. Not 10 years, not 60 years, but 40. Why is the 40 year time frame significant?

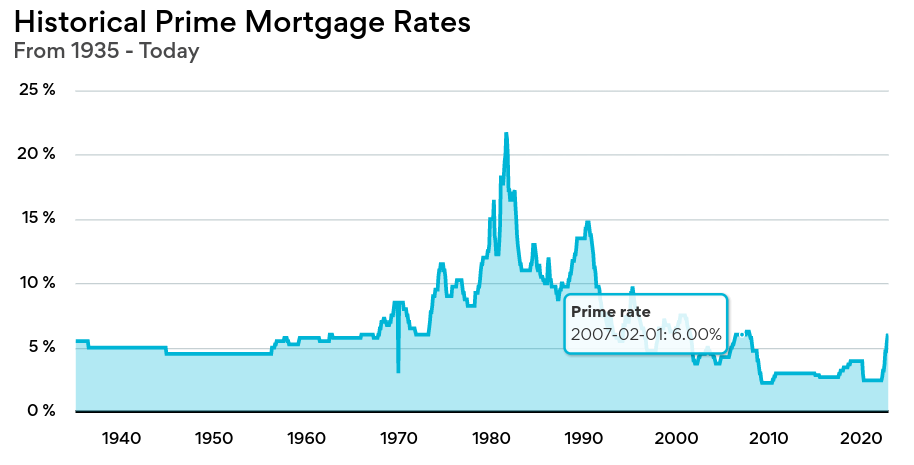

About 40 years ago, in 1982, mortgage rates hit their highest point. Interest rates were in the double-digits (over 10%) and mortgage rates were unusually, uniquely high. Sometimes mortgage rates were higher than 20%.

Prime mortgage rates in Canada from 1935 to 2022

Since 1982, interest rates have gradually come down. Over the next 40 years they almost always dropped, slowly coming down to almost nothing by 2020.

This is important because the appeal of a fixed rate mortgage is it locks you in at a rate you know you can afford. Ideally you want a fixed rate mortgage when you believe rates will rise over time. You want to lock in your rate when it’s relatively low so you don’t get hit by a higher bill later. In other words, when rates are low you want a fixed rate mortgage to keep your costs from rising.

A variable rate mortgage is ideal when rates are high and likely to drop in the next few years. If you believe rates are high at the moment and likely to go down, then you should take a variable rate so your costs drop over time as interest rates fall.

From about 1982 to 2020 anyone who was on a variable rate mortgage benefited because rates were (almost always) coming down from an all-time high. If you took a fixed rate mortgage you were locked in at a higher rate while people on variable mortgages saw their costs gradually decline.

This changed recently. In 2022 we saw mortgage rates take off, starting to climb back up. Since rates were close to zero for a decade (2010-2020), this made sense – rates couldn’t drop and had to go back up eventually.

For over three decades people had been told variable rate mortgages were the way to go because rates kept dropping. And this was good advice at the time. However, once rates got close to zero (from 2010 onward), they clearly couldn’t go down anymore and variable rates no longer made sense. When the interest rate is close to zero, consumers should lock in their fixed rates near the zero mark. The rates had only one way to go: up.

I feel it worth pointing out that, if you look at the above chart, anyone who took out a mortgage in the 1960s and 1970s would have seen mortgage rates shoot up from normal lows of around 4.5% to an insane high of about 20% in 1980. Starting out on a fixed rate mortgage would have been the only safe choice during those two decades as people on variable rate mortgages would have been hit by skyrocketing costs. This is why brokers say things like “Variable rates have always beat fixed rates for the past 40 years,” and not “Variable rates were better for the past 60 years, except those first 20 years where people on variable rates were totally decimated!”

Back to the present, mortgage rates have “bounced” back up a little and there is some question as to whether they will continue to rise for a while, come back down, or hold steady. I don’t have a crystal ball and I’ve heard good arguments for both options. Given the uncertainty of the current market my choice would be to lock in at the current rate. That way there are no surprises. Whether rates go up or down won’t matter as long as your fixed mortgage is currently within your budget.

Taking a variable rate could end up saving you some money if interest rates fall again, but if they continue to climb for a few years it could get expensive. Personally, I suspect rates may continue to rise (or at least hold steady) for a few years. And, when dealing with an important asset such as a house, I think it’s better to be cautious. I’m inclined the think the fixed rate is better, or at least safer, in the short-term.

Comments are closed, but trackbacks and pingbacks are open.