I work as a freelancer and I don’t have any fixed income yet, but I have contracts which cover all my expenses. I also have some funds set aside in case of any issue or if I make a little bit less during a month. I want to start tracking my expenses to see what I spend the most money on, etc. I tried apps such as Hardbacon to track my budget, but they end up being more work than everything. I have to open the app, login, see if my accounts are properly synced, go through each payment and put it in the right category. I’m sure they work great for some people, but I want to manage my budget by myself. I don’t care if I have to put them down manually at the end of each day.

Questions:

- Is my budget okay? Can I just assume I will make $X per month and take money from my savings if I make less and put money aside if I make more?

- What would be the best way to track my budget?

In response to your question about budgeting, I recommend trying to match your spending budget to the lowest income month you typically have. If you have one month where you make $2,500 another with $3,500 and one with $4,000 then I’d recommend trying to live within the $2,500 range.

You’ll have some tight months and fewer luxuries early on, but it’ll give you a cushion. Your emergency savings will dry up really quickly if you have a couple of lean months and your spending budget is your average of good and bad months.

I’ve been a freelancer for about 13 years and, especially early on, the incoming payments tended to be all over the place. Setting my budget low and saving up for stuff I wanted while padding the savings account really helped me stay afloat during the slow months.

As for budgeting, the existing approach to tracking your budget seems over-engineered. I find it’s best not to overthink budgeting software. It sounds like you’re using something that needs a login and sync options between devices and then tries to guess your spending category.

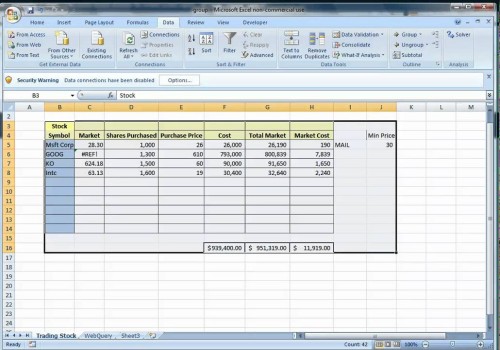

You’ll save a lot of time and headaches if you set up a spreadsheet. When you buy stuff either get a receipt or jot the item and amount in any note taking app on your phone. At the end of the day (or end of the week) copy the items from your phone and the receipts into the spreadsheet.

I have a spreadsheet that tracks all income on one page and all expenses on another. Each item has the date, item name, dollar amount, and category. Like “July 1, groceries, $50, home/food”. It takes about two minutes per week to fill it in, with no syncing or logins required.

The spreadsheet then makes it easy to sort items by name, cost, or category and totals up everything for you.

Comments are closed, but trackbacks and pingbacks are open.