When it comes to making a budget, and sticking with it, one of the most essential elements is keeping track of your income and your spending. To make good financial decisions we first need good information. This may sound like a simple idea, but it’s one people understandably struggle with because so much of the money flowing in and our of our bank accounts happens transparently.

In the past people used cash and they could physically see how much they were spending and how much money they had remaining in their wallet or purse. You could glance in your wallet and quickly determine how much money you had left over. Whenever someone gave you money or accepted a payment from you there was a physical transaction of one person handing another money – it was difficult to miss.

Later, with cheques becoming a common method of payment, people still had to pause and write out how much a cheque was worth and would generally jot it down in their own booklet. Chances are if you were taking the time to write a cheque you were also keeping a running balance of your costs in the booklet.

These days almost all payments happen with the click of a button or the tap of a credit card. A lot of people don’t even carry physical cash. Fees and transfers flow in and out of our bank accounts, sometimes multiple times a day, without us noticing or being told. There is rarely a physical marker or record of our income or spending anymore and this results in money transfers being more transparent. This means we need to be more proactive when it comes to keeping track of money going into and coming out of our accounts.

The good news is banks and credit card companies now provide up to date, on-line records to make accessing this information fairly easy. What I recommend doing is, about once every week or two, sign into your bank’s website (or credit card website) and look at the flow of money coming into your bank account and the money going out through your bank and credit card accounts.

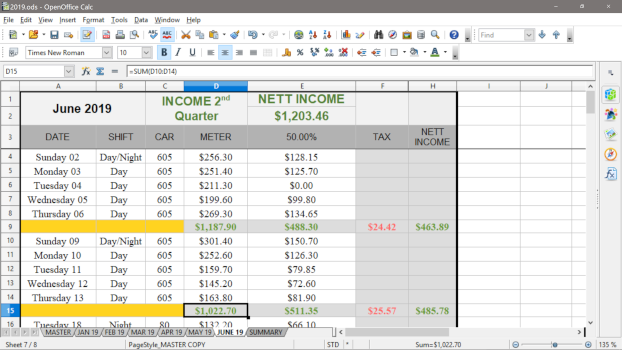

Then write out that information into two columns. I like using a spreadsheet for this, but it’s just as effective to write out the information on a piece of paper. Keep track of the cost of each transaction and what it was for. My budget sheet looks like this:

|

|

This is a very short example, but it gives you an idea of what the income list and expenses list will look like. This gives us a quick way of seeing whether we have more money flowing into our bank account or going out. It’ll also give us a look at which costs are taking up the most of our budget. This is important because, as I mentioned before, to make good decisions first we need good information.

Once we have written out all our income and costs we know where our money is going, and how much we are spending compared to how much we make. Now we can start browsing through the list looking for costs we don’t need. Is there anything that stands out? Are we spending a lot of money on eating at restaurants? Are there a lot of on-line clothing purchases? Did we make too many trips to the coffee shop this month? This list should show us that.

I like to rewrite the list once it’s all out on paper and place the expenses in order of greatest to smallest. Often big ticket items like mortgage, car payments, and groceries will be at the top. Smaller items tend to be snacks, office supplies, a book to read, and streaming services.

There are two key types of items I recommend watching for. One is single large items you don’t need. Things like trips to restaurants, game consoles, or a new TV. Anything that is a large purchase that isn’t necessary should be looked at and considered. Is it important? Is it something you’re seeing regularly on your monthly budget list? Is it something you can avoid purchasing in the future?

The other key item to look at, and I’ll talk about this in more detail in another budgeting tip, is watch out for repeating small transactions. One cup of coffee might only cost $2, but if you do that every work day for a year you’ve spent about $500. Getting a couple of bottles of wine to share with friends every weekend might only cost around $40 at a time, but it’ll run you about $2,000 per year. I used to be guilty of picking up a chocolate bar during my lunch break, but that little $1.50 indulgence added up to around $300 a year. Having all three of these habits will cost nearly $3,000 per year. It’s a sobering thought to realize changing just a few small habits could be the difference between paying off your credit card this year or next year.

Once you have figured out which big items you don’t need or which small, repeating items you can live without, make an effort to stop spending money on those things. This will lower your expenses and, hopefully, make your expenses column add up to less than your income column in your records.

Comments are closed, but trackbacks and pingbacks are open.